Payroll Tax Services

We’re here to eliminate tax compliance headaches for good.

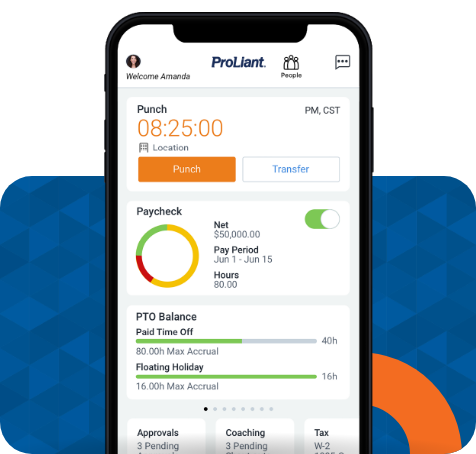

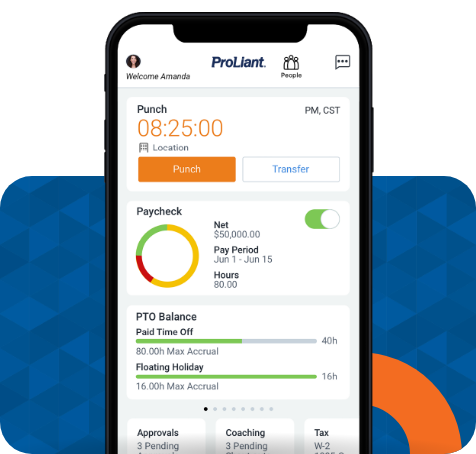

There’s a lot to remember when preparing and filing tax returns, from ever-changing laws and regulations at the local, state, and federal levels to new payroll tax forms. Let ProLiant do the work for you so you can focus on your business. From filing and paying taxes to processing W-2s and 1099s and finding tax credits like WOTC, you can trust our Certified Payroll Professionals accurately prepare, review, and file all necessary documents.