Why Payroll is Important

Discover the crucial reasons why proper payroll management is essential for your business success:

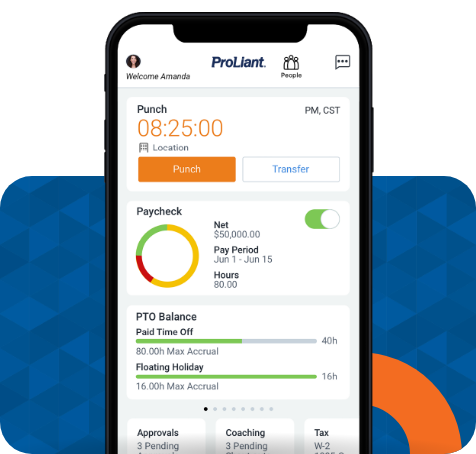

Paying Employees

Organizations must ensure that their employees get paid promptly and accurately, and a reliable payroll system can help. Failing to provide employees with their complete salary or hourly wages not only amounts to stealing from them but also violates the law. The U.S. Department of Labor, Wage, and Hour Division has established a comprehensive set of guidelines that cover various aspects, including minimum wage, paydays, overtime pay requirements, permissible deductions, and employee exemptions. Failure to adhere to these regulations can result in severe consequences for employers, such as compensating employees for back wages, paying waiting time penalties, covering attorney fees, paying liquidated damages, and potentially facing criminal or civil penalties.

Withholding and Filing Taxes

The federal government requires businesses to set aside a portion of each paycheck for the employer and employee. These withholdings cover Social Security, Medicare, Unemployment, and Federal Income Tax. Additionally, employers have the responsibility to pay state income taxes and state unemployment and disability taxes. Certain states may sometimes request additional taxes, like a job-training tax. It is crucial to fulfill these tax obligations as failure to do so may lead to mild penalties, gentle reminders or requests for payment against the taxpayer's property, and even potential tax audits.

Compliance

Filing payroll taxes comes with its own set of rules and regulations at the federal and state levels. Failure to file on time could result in substantial fines or penalties. Additionally, any mistakes made with an employee's pay must be promptly corrected to avoid liability. Maintaining compliance is of utmost importance. Businesses must collect a W-2 form from each employee and submit it to the Social Security Administration by April to steer clear of any legal issues with the IRS.