Valuing employees in the workplace leads to increased productivity, happiness, and reliability. A study by Mercator Advisory Group revealed that flexible pay benefits employees and results in a 27% increase in job retention. Here are the reasons why:

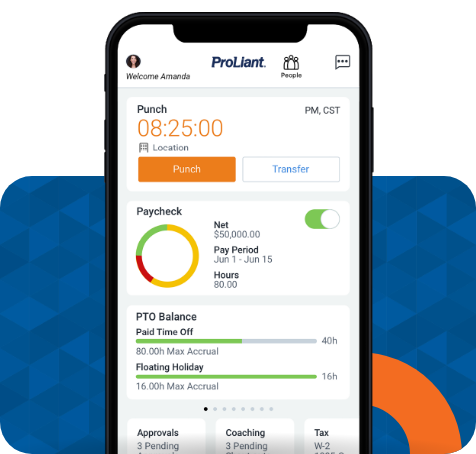

Financial Wellness

With EWA, employees can take charge of their finances and cover essential expenses like bills and groceries. EWA can also boost their overall financial well-being. Unfortunately, over 50% of American workers live paycheck to paycheck, leaving them vulnerable to late payments and service disconnections that can damage their credit scores. In dire situations, employees may rely on credit cards or payday loans, with hefty fees and high-interest rates. You can help your workers avoid overdraft fees, payday loans, and credit card interest by giving them access to on-demand pay providers. Access to on-demand pay providers allows them to manage their budget and make smarter financial choices that work for their unique situation.

Flexibility, Stability, and Security

Employees can better manage how and when they receive their hard-earned money, making aligning with their financial obligations more manageable. In addition, they can access emergency funds instantly to cover unexpected expenses without adding to their debt. Plus, those without a bank account can have an alternative solution to access their money.

Savings

Employees can better track their income and expenses, giving them the power to manage their money more effectively and save in the long run.

How Earned Wage Access Supports Core Business Strategy

EWA Has Surpassed Expectations

Employers offering EWA have reported a swift and extensive adoption across their workforce.. According to a survey, 20% of employees expressed their desire to use EWA every or every other pay period. Additionally, out of the employees who already have access to EWA, an overwhelming 62% used it every or every other pay period.

Millennials Prefer Job Offers with EWA

EWA is a game-changer for millennials in the job market. According to recent surveys, 59% of millennials prioritize job offers from employers offering EWA. Moreover, 57% of millennials say EWA availability would influence their decision to accept a job offer. By offering EWA, employers can gain a competitive edge in recruiting and retaining top talent.

Recruitment & Retention

EWA can set your company apart in a competitive job market and help you attract a wider pool of applicants while speeding up the hiring process. Recent survey results show that employees of all ages, educational backgrounds, and income levels place a high value on EWA, making it a critical factor in today's labor market. You can attract new talent and retain your current workforce by offering EWA. Studies indicate that EWA can increase employee loyalty by 78% and reduce turnover by almost 36%.

Productivity

Financial stress is a shared concern today; your employees are no exception. The burden of bills can weigh heavily on financially strapped employees, leading to decreased productivity and availability at work. Reducing their financial worries can boost their focus and productivity, making them feel more valuable. EWA provides a perfect solution by offering your employees visibility into their daily earnings and immediate access to cash. With financial confidence, your employees will be more involved and productive at work and less likely to be distracted by stress or the need for a second job.