Understanding Benefits Administration

Definition and Scope

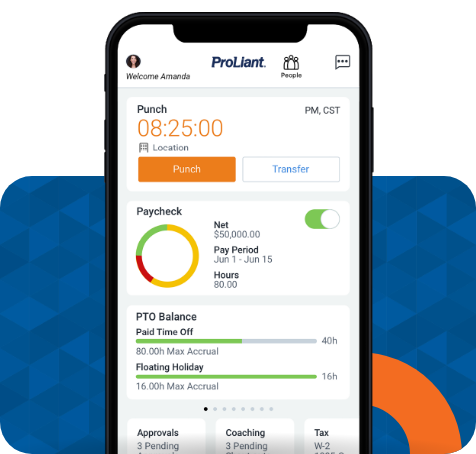

Benefits administration is all about managing the various perks and advantages that organizations provide to their employees. These benefits go beyond just a paycheck—they include health insurance, retirement plans, paid time off, and more. The goal of benefits administration is to ensure that these offerings are managed efficiently, comply with legal standards, and meet the needs of both the employer and the employees.

Key Components of Benefits Administration

Let’s dive into the core elements that make up a comprehensive benefits package:

Health Insurance

Health insurance is often the cornerstone of employee benefits. It provides employees with access to medical care and financial protection against high healthcare costs. Effective benefits administration ensures that employees understand their health insurance options, how to enroll, and how to make the most of their coverage.

Retirement Plans

Retirement plans, such as 401(k) or pension plans, help employees save for their future. Administering these plans involves setting up the right options, managing contributions, and providing education about the benefits of long-term saving. A well-managed retirement plan can be a significant factor in attracting and retaining talent.

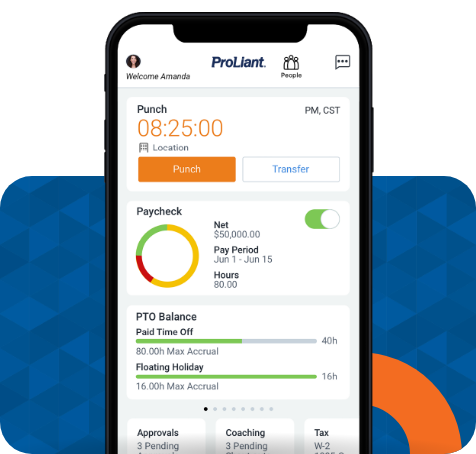

Paid Time Off (PTO) and Leave Policies

Paid time off and leave policies are essential for maintaining work-life balance. This includes vacation days, sick leave, and parental leave. Clear policies and efficient tracking ensure that employees can take the time they need without impacting their work or pay.

Employee Assistance Programs (EAP)

Employee Assistance Programs offer support for employees dealing with personal issues that might affect their work performance or well-being. This can include counseling services, legal assistance, and financial planning. Effective administration of EAPs ensures employees know these resources are available and how to access them.

Wellness Programs

Wellness programs aim to promote healthy lifestyles among employees, which can lead to reduced healthcare costs and increased productivity. These programs might include gym memberships, health screenings, and wellness challenges. A good benefits administration system will encourage participation and track the program’s impact on employee health.

Legal and Regulatory Considerations

Navigating the legal landscape is a critical part of benefits administration. Employers must comply with various laws and regulations, such as the Employee Retirement Income Security Act (ERISA), the Affordable Care Act (ACA), the Consolidated Omnibus Budget Reconciliation Act (COBRA), and the Health Insurance Portability and Accountability Act (HIPAA). Staying compliant involves keeping up with changes in legislation, ensuring that benefits are administered according to the rules, and maintaining accurate records. Failure to comply can result in significant penalties and legal issues.

Understanding benefits administration is the first step toward creating a robust and effective benefits program. By mastering these key components and staying informed about legal requirements, you can ensure that your benefits administration process runs smoothly and supports your organization’s goals.